Affiliate payouts are not simply about ensuring partners get paid on time. In fact, it is a way to form a genuine brand image while maintaining strong customer relationships and loyalty.

As an e-commerce store owner, you already know how important it is to keep your affiliate partners happy and motivated. Consequently, this might directly impact the quality of promotion of your products.

Many brand owners struggle with managing affiliate marketing payouts efficiently. Therefore, along with delays and dissatisfaction, this will also lead to distrust.

When payments are delayed or inconsistent, affiliates may become frustrated and choose to work with others.

To avoid all this confusion, in this blog, we discuss how your affiliate payment solutions can be automated.

In addition, you can explore different affiliate payout models and everything else, from payment schedules to affiliate commission structures, that will work best for you.

Schedule your affiliate payment system and boost affiliate partner satisfaction instantly with Afflr.

What Are Affiliate Payouts?

Affiliate payouts are the commission paid to affiliate marketers in exchange for the traffic or sales they bring.

Affiliate Payments can be awarded on completion of sale, bringing referred customers, or simply increasing CTR (click through rate). Following that, you can offer a fixed amount or percentage of sale as a commission.

Affiliate commission payouts can impact your marketing budget, affiliate interests, and, ultimately, the success of your affiliate program. Therefore, having in place a clear affiliate payment system is important.

Why Are Efficient Payouts to Affiliates Important for Affiliate Marketing?

The reasons why efficient payment is important for an affiliate program are:

- Build Loyalty: If you delay affiliate program payouts, then it can reduce the trust in your brand. Therefore, by rewarding your affiliates on time, you can keep them loyal and happy to associate with you.

- Motivate Affiliates: You can optimize the affiliate commission to ensure affiliates get the right incentives for their efforts. As a result, the affiliates will stay motivated to promote your brand.

- Save Time: A good affiliate payment processing system will help you automate transactions and prevent delays. Consequently, you can reduce manual paperwork and optimize affiliate management.

- Attract Quality Brand Advocates: You can use clear payment terms and reliable processes like affiliate networks that pay weekly to give affiliates regular earnings. Thus, you can recruit affiliate partners who can highly contribute to growing your brand’s reach.

What are the Types of Affiliate Payout Models?

The common types of affiliate payout structures that can help you create a successful affiliate program are:

- Pay Per Sale (PPS): You can pay commission when referred visitors make purchases.

- Pay Per Lead (PPL): You can make the payment for quality lead generation through affiliate marketing.

- Pay Per Install (PPI): Rewards are given to the affiliates for actions like app or software installations or downloads.

- Pay Per Click (PPC): Commission can be paid based on the traffic generated by referral partners through clicks in their unique affiliate link.

- Tiered Commission: With such recurring payments in affiliate programs, the payment rate is increased based on performance.

- Hybrid Models: In this method, you can combine two or more affiliate payment structures from above based on your business requirement.

Best Affiliate Payout Methods for E-Commerce Owners

The best affiliate payout methods are:

- PayPal

- Direct Bank Transfers

- Cheque

- Store Credit/ Coupons

- Gift Cards

- Cryptocurrency

- Razorpay

- Amazon Pay

- Stripe

1. PayPal

PayPal makes remote transactions easy with no hassle, as you only require your affiliate’s PayPal ID. As a result, the PayPal affiliate payout option is the most commonly used method.

Pros:

- Easy setup with minimal paperwork

- Mass payment features for efficient processing

- Detailed transaction history and reporting

- Familiar to most affiliates

Cons:

- Higher fees compared to some alternatives

- Account limitations in certain countries

- Currency conversion fees for international payments.

2. Direct Bank Transfers

It is a traditional method for sending payments directly to an affiliate’s bank account.

Pros:

- Good for larger payment amounts

- Familiar and trusted by most affiliates

- Often preferred by professional affiliates

Cons:

- Higher processing fees

- Longer processing times

- More administrative work for your team

3. Cheque

You can offer a physical cheque to affiliates through mail or hand it over in person.

Pros:

- Works without internet access

- No electronic payment account is required

- Good for regions with limited banking options

Cons:

- Slow delivery times

- Processing fees and postage costs

- Manual processing requirements

4. Store Credit/ Coupons

It is an alternative affiliate payout where earnings are added to affiliates’ accounts as store credit or unique discount codes. Subsequently, your customers can use it for further purchases on your site. Thus, you can encourage customer retention.

Pros:

- Encourage repeat purchase

- Can offer higher value than cash equivalents

- No payment processing fees

- Best way to turn customers into brand advocates

Cons:

- Less attractive if affiliates prefer cash

- Difficult to track for accounting purposes

- Instant payment for affiliate programs

5. Gift Cards

You can send digital or physical gift cards to affiliates as a reward instead of direct cash transfers.

Pros:

- More tangible reward than store credit

- Transferable so affiliates can give them as gifts if desired

- Partner with multi-brand gift card providers for greater flexibility

Cons:

- Administrative overhead of purchasing and distributing

- Regular monitoring of expiration dates

- Less appealing than cash

6. Cryptocurrency

Affiliate Bitcoin payout has gained popularity recently. Here, you can use digital currencies like Bitcoin or stablecoins for payments across the globe.

Pros:

- No international transfer fees

- No need for traditional banking infrastructure

- Complete payment transparency

- Popular with tech-savvy affiliates

Cons:

- Price volatility (except with stablecoins)

- Technical complexity for beginners

- Tax and regulatory confusion

- Not widely adopted by all affiliates

7. Razorpay

Razorpay is a popular affiliate payment gateway solution that is expanding globally. In fact, you can easily process and disburse payments for affiliates.

Pros:

- Quick setup with minimal documentation

- Built-in compliance with local regulations

- Multiple payout options, including UPI, bank accounts, and wallets

Cons:

- Primarily focused on the Indian market

- International transfers may incur higher fees

- Limited availability in certain regions

8. Amazon Pay

Amazon Pay is presented by the globally most trusted and used platform, Amazon. Thus, it is widely used as an affiliate payment option.

Pros:

- Trusted brand recognition

- Strong security measures and fraud protection

- Convenient for affiliates who already use Amazon

Cons:

- Higher processing fees than some alternatives

- Limited global coverage compared to PayPal

- Requires affiliates to have Amazon accounts

9. Stripe

Stripe is a developer-friendly payment processing platform for affiliates.

Pros:

- Extensive documentation and easy integration

- Support for 135+ currencies

- Advanced reporting tools

Cons:

- More complex setup compared to PayPal

- May require technical resources to implement fully

- Higher fees for international transfers outside major markets

Implement Afflr’s automated payment solution to eliminate manual errors and save hours of administrative time.

How to Create the Affiliate Payouts Structure for Your Program?

The steps to create an affiliate payout structure are as follows:

Step 1: Determine Affiliate Minimum Payout Threshold

Firstly, set a minimum amount that your affiliates must reach before a payout request. Thus, you can reduce transaction fees and administrative work for smaller amounts.

Step 2: Define Your Commission Structure

Then, choose from the different affiliate commission models. Following that, be transparent about commission rates and tracking.

Step 3: Select Your Payment Frequency.

Following that, choose how often you’ll process payments (weekly, bi-weekly, or monthly). Then, consider your cash flow, administrative workload, and affiliate expectations.

Step 4: Choose Payment Methods.

Then, select which payment options you’ll offer. Consequently, consider factors like location, transaction fees, etc, while choosing affiliate marketing payment methods.

Step 5: Implement Payment Automation

Following that, you can set up systems for managing payments to affiliates effectively. Subsequently, automating payment processing can reduce administrative overhead. Therefore, choose affiliate payout software that integrates with your e-commerce platform and payment providers.

Step 6: Create Documentation and Resources

You can develop clear guides explaining your affiliate commission model. Hence, give them examples of commission calculations or contact information for support.

Step 7: Design Bonus Structures.

Set aside extra pay for affiliates who perform very well. These bonus structures motivate your best brand ambassadors to perform better.

Step 8: Provide Affiliate Portal

You can offer a dedicated affiliate dashboard for affiliates to view their performance metrics and request affiliate payments.

Step 9: Set Up Tracking and Reporting Tools

You can use an affiliate tracking software to track performance, commission, and payment details. Thus, optimize your affiliate commission rate.

Step 10: Create a Review Schedule

You can regularly evaluate and optimize your payout structure. Following this, adjust commission rates, bonuses, and payment methods based on referral program performance and affiliate feedback.

Why is Affiliate Payment Software Needed?

Affiliate payment software has multiple features apart from automating the payouts. Some of the key features are:

- Automated Commission Calculation: You can apply the right commission rate by effectively tracking the affiliate link.

- Payment Scheduling: Easily notify payments on predetermined dates.

- Multiple Payment Methods: You can pay using various payout options from one place.

- Document Generation: You can create necessary forms for tax compliance and other affiliate marketing payment proof.

- Performance Reporting: You can get insights on the success of your affiliate marketing campaign.

- Fraud Detection: Use some of the in-built features to prevent any fraudulent activities.

Explore more affiliate apps (Shopify-specific) for a better understanding.

How to Automate Affiliate Payouts for Easy Processing?

Automating affiliate link payouts is quick and easy with the help of software.

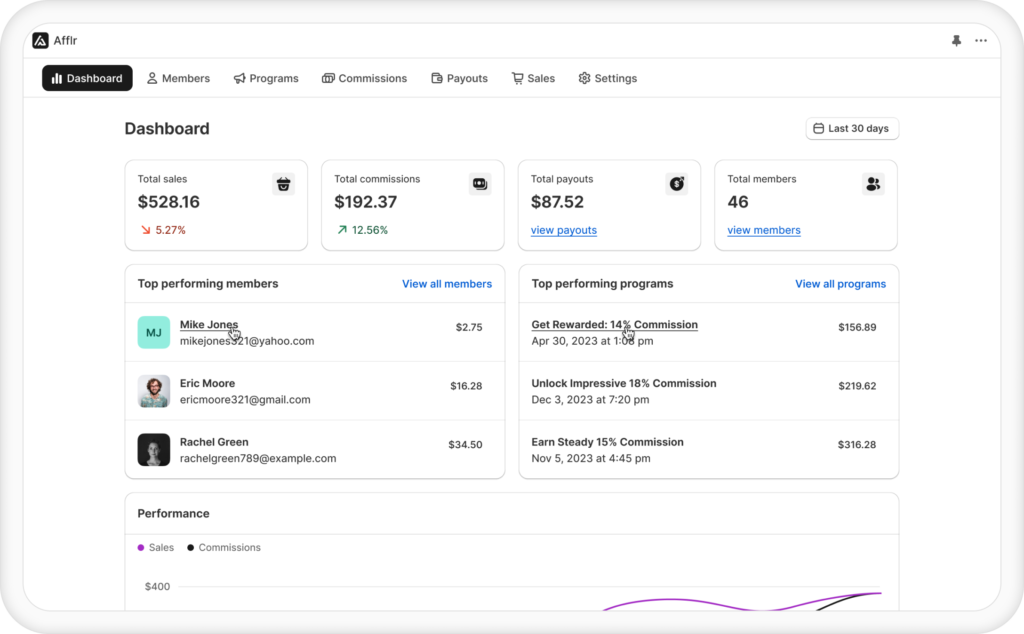

Here, let’s explore how to automate Shopify affiliate payout using Afflr, a Shopify affiliate app.

If you are using the Shopify platform for your e-commerce store, then Afflr is the best choice to create and manage your affiliate, referral, and influencer programs.

Check out this quick guide to install Afflr.

Following that, explore how to set the affiliate commission for your store.

Now, let’s see how easy it is to automate payouts of affiliates.

Step 1: Set the Affiliate payouts threshold

- With Afflr, to set a payment threshold,

- Go to Afflr dashboard -> Settings -> General

- Then, scroll down to Payout Settings and set your threshold.

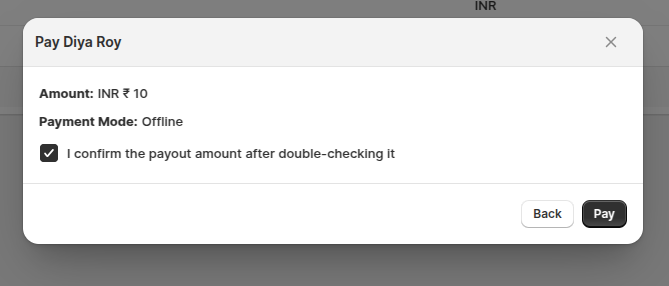

Step 2: Initiate Payment to Affiliates in One Click

To affiliate on one click using Afflr,

- Go to Afflr dashboard -> Payouts -> Balance tab

- Then, click the “Pay” button near the name of the affiliate to be paid

- In the next tab, choose the affiliate program payout method and click Next

- Following that, confirm the payment amount and complete the payment processing.

Afflr lets you integrate your store with an affiliate payment gateway like PayPal and a gift card provider like Tremendous for flexible payout offerings.

Related Reading: Learn more about how affiliate marketing integrations can help with payouts for affiliates.

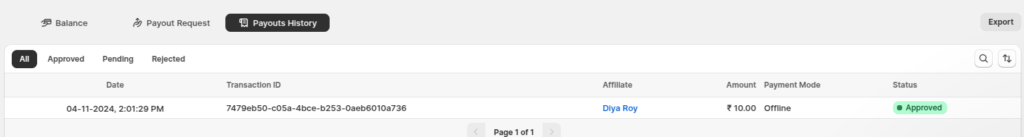

Step 3: Track Payouts to Affiliates

Tracking payouts to affiliates with Afflr is simple as it records all payment-related activity. So, you need to simply go to Afflr dashboard ->Payouts -> Payment history tab.

In addition, you can also export these details for future use and accounting purposes.

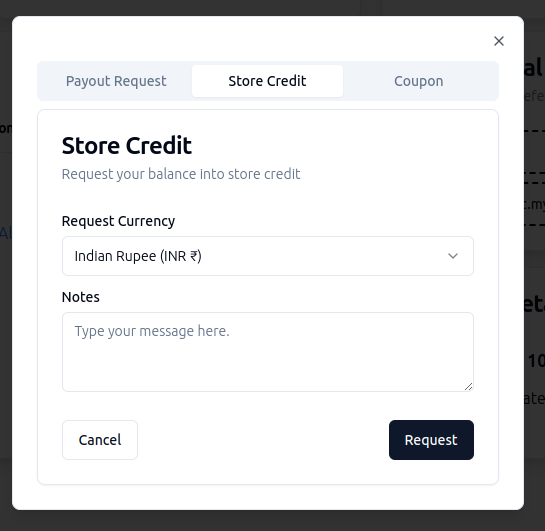

Bonus: Affiliate Payment Request

Afflr allots an affiliate portal to all your affiliates. Therefore, they can easily monitor their performance there.

In addition, they can request the required payout in any method they want, like store credit, coupon, etc.

How to Optimize Affiliate Payouts for Growth?

Here are some strategies to optimize growth with the best affiliate payouts:

- You can offer performance-based rewards. As a result, your engagement will increase. When your affiliate marketers feel valued, they’ll continue to prioritize your products.

- Explore successful affiliate programs with the highest payout to improve your marketing efforts. Thus, you can easily attract affiliate marketing publishers.

- Programs offering the highest affiliate payouts tend to attract better-quality affiliates. Therefore, investing more in commission rates will result in higher-quality traffic and conversions.

- Providing affiliate marketing payment proof builds trust and attracts new partners. Therefore, transparency about your payment history can be a powerful affiliate recruiting tool.

- What works for fashion might not work for electronics. Therefore, use the right affiliate marketing strategies suitable to your industry standards.

Access exclusive payment options with Afflr and drive exponential sales growth.

Conclusion

The right affiliate payment solutions can reduce friction in the payout process and can contribute vastly to the successful running of your affiliate marketing program.

You can start with a simple yet competitive affiliate program payout system. Following that, based on what we have discussed in the blog, you can offer top affiliate payouts while maintaining profitability and easily automate it.

Further Reading

- How to Start Affiliate Marketing for Shopify Stores?

- Top Affiliate Marketing Products to Sell in 2025

- Affiliate Marketing Pros and Cons: Is It Right for You?

- Proven Strategies for Shopify Affiliate Growth

Frequently Asked Questions

You can receive affiliate payments through popular methods like PayPal, direct bank transfers, store credit, coupons, etc. You can set up your preferred payment account and process payout when the minimum threshold is met.

The average affiliate payout ranges from 5% to 30%, depending on the industry. Hence, you can set the earnings based on product price, profit margin, and performance bonuses.

The Amazon affiliate program pays 10% for the traffic and sales the referral partner brings. Once the $10 threshold is reached, payments are processed after 60 days.

Payment processing in an affiliate program can happen in five steps: tracking sales, calculating commissions, reaching the threshold, approving commission, and distributing payments.

An affiliation payment is the commission earned for promoting a brand and driving sales. These payments can be percentage-based, fixed-amount ($5-50 per action), or recurring.

As an affiliate, you get paid for bringing sales to a store. You can receive rewards through your chosen payment method on the program’s payment schedule.